Many people utilise chart patterns for their decision-making process in their investments. The question here is can we automate a chart-pattern recognition process?

If possible, we can examine, for example, the correlation between chart patterns and future prices.

We used YOLOv5 for that purpose.

We attempted twice, and both failed.

First, we tried to detect chart patterns from pictures of candlestick charts.

We made 69 labelled training data and 5 test data. It did not detect anything at all after training for 200 epochs.

The first picture below is a labelled picture. Note that the first picture is a picture from the validation data I labelled, not the prediction that AI made.

The second is the prediction result. No pattern is detected.

presumably, it was because a candlestick chart with Moving Average indicators on it might be too complex, and the information it contains was redundant for the purpose.

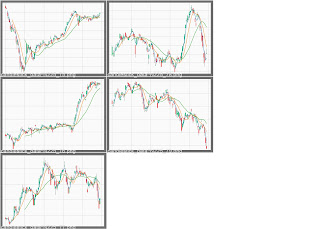

Second, we changed the training pictures into 2D line charts and labelled 44 pictures. It does not, however, detect any patterns again after training. Well, usually, in this case, we might need more data to make the model learn correctly.

We will prepare more data for the YOLO to learn.

Also, we have been developing stock/index prices analytic scripts in python here https://github.com/LulutasoAI/FInancial_Analysis. we will explain the script and its usage in the following article. Stay tuned.